For anyone thinking about getting their certified public accountant license in Indiana, there are a few important steps you need to take. You see, it's not just about wanting the license; there are some pretty clear rules set out, like needing to pass all four parts of the big CPA examination. Then, you also have to show you've got the right education and some real-world work time under your belt, which, you know, makes a lot of sense when you think about it.

This whole process can seem a bit much, what with all the studying and the actual tests, but there are places that help make it smoother. One of those places, Becker CPA, is pretty well-known for helping people get ready for that big exam. They also offer ways for folks already in accounting and finance to keep learning, which is called continuing professional education, or CPE for short.

It's a big deal to get through these requirements, and having a good guide can make all the difference. That's what a lot of people look for when they're trying to move forward in their careers, especially when it comes to something as important as becoming a certified public accountant.

Table of Contents

- What Does It Take to Become a CPA in Indiana?

- How Does Becker CPA Help with the Exam?

- What About Continuing Education with Becker CPA?

- Are There Different Ways to Learn with Becker CPA?

- How Does the Concierge Package Work with Becker CPA?

- Does Becker CPA Also Help with the CMA Exam?

- What is the Exam Day Ready Toolkit from Becker CPA?

- What About the FAR Section of the CPA Exam with Becker CPA?

What Does It Take to Become a CPA in Indiana?

Becoming a certified public accountant in the state of Indiana involves a few specific steps that aspiring professionals really need to complete. You see, it's not just a matter of deciding you want the title; there are some very clear guidelines set out by the state. First off, anyone hoping to get their license has to successfully pass all four parts of the CPA examination. This is, you know, a pretty big test, covering a wide range of topics related to accounting principles and practices. It's a comprehensive assessment, testing how much you truly grasp the material.

Beyond successfully completing the examination, there are also some requirements related to your schooling and your work experience. You have to make sure your educational background meets what they are looking for, which often means a certain number of credit hours in specific subjects. Then, there's the practical side of things: you need to gain some real-world work experience, usually under the guidance of someone who is already a licensed CPA. This hands-on time helps you put all that book knowledge into practice, which, as a matter of fact, is pretty important for a job like this. These steps are all put in place to make sure that anyone earning the CPA designation is truly ready for the responsibilities that come with it.

So, it's a bit of a process, with the exam being a central part of it, but also the academic background and the practical experience counting for a lot. It’s a way of ensuring that those who earn the certification are well-rounded and capable. This structure helps maintain the high standards associated with being a certified public accountant, which is, you know, what everyone wants to see in someone managing important financial matters.

How Does Becker CPA Help with the Exam?

When it comes to getting ready for the certified public accountant examination, Becker CPA provides a wide range of materials and support designed to help people prepare. They offer what you might call a complete review for the exam, which means they cover all the subjects and types of questions you're likely to see on the actual test. This is for individuals who are just starting their journey to become certified public accountants, as well as those who might be working in finance already but want to take that next big step. It’s a way to get all your ducks in a row before the big day.

They also provide ongoing learning opportunities for professionals who are already working in accounting and finance. This is known as continuing professional education, or CPE. These programs are for people who need to keep their skills sharp and stay up-to-date with changes in the field. It’s pretty important, actually, for professionals to keep learning throughout their careers, and Becker CPA seems to understand that need. They aim to be a resource for both those just starting out and those who are already established in their work.

So, whether you're looking to pass that first big exam or just need to keep your professional knowledge current, Becker CPA aims to have something for you. They focus on providing the kinds of materials and instruction that can really make a difference for someone trying to get ahead in the accounting and finance world. It's all about giving people the tools they need to succeed, which is, you know, what any good educational program tries to do.

What About Continuing Education with Becker CPA?

When we talk about continuing professional education, or CPE, with Becker CPA, there's a specific detail that might be worth noting about how certain hours are counted. The information suggests that only a portion of your CPE hours, perhaps 50 percent, or a specific amount like 60 hours, might be considered in a particular way. This could mean that out of your total required CPE, a certain amount, perhaps 60 hours, comes from specific types of activities or sources that Becker CPA provides. It's a detail that professionals keeping track of their ongoing education would want to be aware of.

This kind of detail is important for professionals who need to maintain their licenses by fulfilling continuing education requirements. Knowing how many hours count, or how a certain percentage is applied, helps people plan their learning activities effectively. It allows them to make sure they are meeting all the necessary criteria to keep their professional standing. So, it's pretty clear that understanding these specifics about CPE is a key part of staying certified and active in the field, and Becker CPA provides information related to these requirements.

It seems, too, that this specific mention of "50% or 60 hours" is a particular point within the broader scope of their continuing education offerings. It's a piece of information that helps clarify how certain aspects of CPE are structured or recognized when you're using Becker CPA's resources. This is, in some respects, a very practical detail for anyone looking to use their services for ongoing learning.

Are There Different Ways to Learn with Becker CPA?

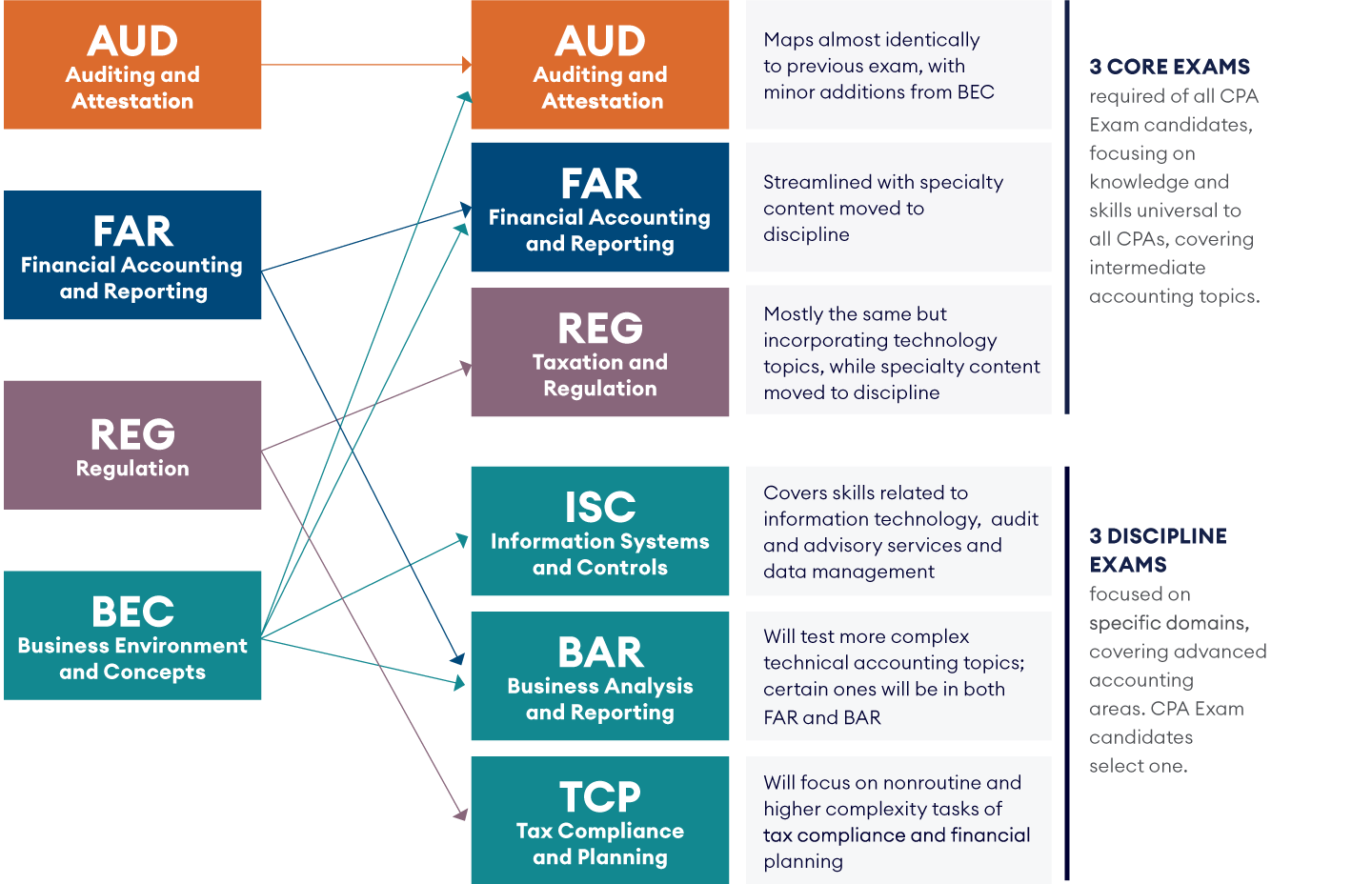

Becker CPA offers different ways for people to get ready for their exams, and this includes access to a set of core courses along with the choice of an additional specialized course. So, you get to study three main sections that are considered central to the exam. These core sections cover the foundational knowledge that every candidate needs to have a firm grasp of. It’s like getting the main building blocks in place before you move on to anything else. This approach seems to ensure that everyone covers the most important parts of the exam material.

Then, on top of those core courses, you also get to pick one more course from a list of specialized subjects. This choice allows you to focus a little bit more on an area that might be particularly relevant to your interests or your career goals. It means you can customize your study plan just a little bit, which is pretty useful. This flexibility in choosing a discipline section course means that the learning experience can be a bit more personal, allowing you to fine-tune your preparation for the exam. It gives you, you know, a bit of control over your study path.

This structure, combining essential core knowledge with a chance to specialize, helps people build a solid foundation while also addressing specific areas they might want to concentrate on. It suggests that Becker CPA aims to provide a comprehensive yet somewhat adaptable learning experience for those working towards their certification. It’s about giving you the general knowledge you need, but also a little bit of room to make it your own, which is, in fact, a good thing.

How Does the Concierge Package Work with Becker CPA?

For those who are looking for a very high level of assistance as they work toward passing the CPA exam, Becker CPA offers what they call a concierge exam review package. This particular package is designed to provide a lot of extra support, aiming to give you the best chance to succeed. It's about having someone there to help you every step of the way, making sure you feel as ready as possible for the big test. This seems to be their most comprehensive offering for exam preparation, really.

Part of what makes this concierge package stand out is the inclusion of private CPA exam tutoring. This means you get one-on-one help from someone who truly understands the material and the exam process. Having a personal tutor can make a huge difference, allowing you to ask specific questions and get explanations that are just for you. Then, there's also personalized coaching, which goes beyond just academic help. This coaching helps you with things like study strategies, managing your time, and keeping your motivation up, which, you know, can be just as important as knowing the facts.

So, this package is all about giving you a very personal and supportive experience as you prepare for the CPA exam. It's for people who want that extra layer of guidance and individual attention to feel truly prepared. It’s a very hands-on approach to helping candidates reach their goal of passing the examination, offering a lot more than just study materials. It's almost like having a personal guide for your entire study process, which, in a way, can be very reassuring.

Does Becker CPA Also Help with the CMA Exam?

Beyond helping people get ready for the CPA exam, Becker also provides assistance for financial professionals who are aiming to pass the CMA exam. The CMA, or Certified Management Accountant, exam is another important credential for those working in finance, and Becker offers resources specifically for this test. Their goal here is to give these professionals the necessary tools and support so they can pass the CMA exam more quickly and, if possible, on their very first try. This shows they cater to a broader audience within the financial sector.

What's more, the resources they offer for the CMA exam are set up to be quite flexible. They are available "on demand," which means you can access them whenever it suits your schedule. This kind of setup is really helpful for people who have busy lives, maybe balancing work, family, and study. It allows you to fit your preparation around your lifestyle, rather than having to completely change your routine to study. This adaptability is, you know, a pretty big plus for busy professionals trying to further their careers.

So, whether you're looking to become a CPA or a CMA, Becker seems to have options available to support your professional development. They focus on providing materials that are not only comprehensive but also convenient, which, in some respects, makes the whole process a bit easier to manage. It's about giving financial professionals the means to achieve their certification goals in a way that works for them, which is, actually, quite thoughtful.

What is the Exam Day Ready Toolkit from Becker CPA?

Every single one of the CPA exam review packages offered by Becker comes with something they call the "Exam Day Ready SM Toolkit." This sounds like a collection of items or resources specifically put together to help you feel completely prepared and confident when the actual exam day arrives. It's probably designed to cover those last-minute details and provide a sense of calm and readiness. This inclusion across all packages suggests it’s a core part of their offering, something they believe every student needs.

And speaking of students, there are also details about how current Becker students will move smoothly into the new Becker CPA Exam Review for CPA Evolution. This means that if you're already studying with Becker, you won't have to worry about big changes or disruptions as the CPA exam itself changes. They've apparently thought about how to make that transition as easy as possible, so your progress isn't interrupted. This kind of smooth transition is, you know, pretty important when you're in the middle of preparing for something as significant as a professional exam.

Beyond that, you can get to CPA online learning materials and other helpful items for exam preparation through Becker's professional education platform. This means that a lot of the study resources are available digitally, which makes them easy to get to from almost anywhere. It's about providing convenience and access to all the necessary study tools. So, it's pretty clear that Becker CPA aims to make the learning process as accessible and stress-free as they can for their students, which is, in fact, a very good thing.

If you're curious about what Becker CPA offers, they also have a free trial that lets you get a feel for their review course and meet their instructors. This trial gives you a chance to see how their lessons are structured and how their teachers explain things, which is a great way to decide if it's the right fit for you. It's a way to try before you fully commit, which is, you know, something a lot of people appreciate. Their free CPA review demo, apparently, also follows the AICPA blueprint, which means it aligns with the official outline for the exam, so you know you're getting relevant information.

What About the FAR Section of the CPA Exam with Becker CPA?

Every person aiming to become a certified public accountant simply must pass the Financial Accounting and Reporting, or FAR, section of the CPA exam to get their license. This particular part of the exam is considered a very important one, covering a wide range of topics related to how financial information is prepared and presented. It's a foundational piece, really, and getting through it is a non-negotiable step on the path to certification. So, it's pretty much a given that you'll need to tackle this section head-on.

While the FAR CPA exam section might seem a bit overwhelming to some, Becker CPA is there to help with that. It's true that the amount of information and the way it's presented on this part of the test can feel like a lot to take in. However, Becker aims to break down that complexity and provide a clear path through the material. They offer guidance and resources specifically designed to help candidates approach the FAR section with more confidence and a clearer understanding. It's about making a large amount of material feel more manageable, which, you know, can be a real relief.

So, even though the FAR section is a big hurdle, Becker CPA seems to be positioned to offer the kind of support that can make it less daunting. They focus on helping you get through this crucial part of the exam, providing the necessary tools to understand and apply the financial accounting concepts. It’s about turning something that might appear challenging into something achievable, which, as a matter of fact, is what good preparation should do. They seem to understand that this section is a key point for many candidates.

In summary, Becker CPA provides extensive support for individuals working to become certified public accountants in Indiana, covering the four exam sections, education, and experience requirements. They offer comprehensive exam review, including core and specialized courses, and even a high-level concierge package with private tutoring and coaching. Beyond CPA preparation, they also assist financial professionals with the CMA exam, offering flexible, on-demand resources. All their CPA review packages include an "Exam Day Ready" toolkit, and current students will smoothly transition to new materials for CPA Evolution. Their online platform provides access to modules and resources, and a free trial allows prospective students to experience their course structure and instructors, with their demo aligning with the AICPA blueprint. Notably, they offer significant help for the Financial Accounting and Reporting (FAR) section, which is a mandatory part of the CPA exam for all candidates.

Related Resources:

Detail Author:

- Name : Ms. Shea Ankunding

- Username : qwilkinson

- Email : delfina.sipes@yahoo.com

- Birthdate : 1980-01-04

- Address : 1405 DuBuque Plaza Suite 691 North Colbyview, SD 07189-6946

- Phone : (628) 419-5336

- Company : Block-Goodwin

- Job : Bicycle Repairer

- Bio : Harum consequatur quidem fuga. Fuga ut sint sed. Nisi necessitatibus minus ut esse unde quia ipsam. Distinctio voluptatem eos eos ut nihil minus.

Socials

twitter:

- url : https://twitter.com/hagenes2005

- username : hagenes2005

- bio : Quidem eligendi commodi optio quidem dolorum earum aut. Qui sunt autem aut natus cumque amet officiis sapiente. A dolore eos optio rerum.

- followers : 1116

- following : 2290

linkedin:

- url : https://linkedin.com/in/rhagenes

- username : rhagenes

- bio : Veritatis eaque numquam quia hic.

- followers : 6794

- following : 295

tiktok:

- url : https://tiktok.com/@rhagenes

- username : rhagenes

- bio : Odio rerum eum deleniti. Hic iste dolores explicabo.

- followers : 3028

- following : 1462

instagram:

- url : https://instagram.com/hagenes1975

- username : hagenes1975

- bio : Est officia suscipit sint ea rem. Eaque est placeat corporis facere repudiandae magni rem.

- followers : 1403

- following : 2202

facebook:

- url : https://facebook.com/reagan.hagenes

- username : reagan.hagenes

- bio : Rerum expedita quod eum magni. Distinctio error molestias cum ut nam.

- followers : 904

- following : 564